Sometimes it is hard to fully identify the risks that your business faces. A&T have developed a collection of Risk Exposure Calculators and Scorecards covering various topics to help businesses understand where precautions may need to be taken within their companies and reduce their exposure to risks.

Directors' & Officers' Liability Calculator

Claims against directors and officers are becoming increasingly common. Your business and its directors and officers could be sued by customers, current or former employees, competitors, regulators, creditors, suppliers or even investors. What’s more, this can happen even if your company is not a large, publicly traded organisation.

The cost of defending directors and officers (D&O) claims can run well into the six figures, leaving a business financially crippled. Even worse, your directors and officers put everything they have on the line, because in the event of a D&O liability claim, even their personal assets may be at risk. As a result, D&O liability insurance has become an essential component of most businesses’ insurance portfolios.

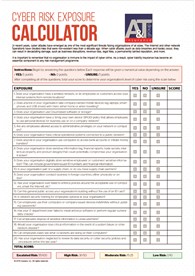

Cyber Exposure Calculator

In recent years, cyber attacks have emerged as one of the most significant threats facing organisations of all sizes. The Internet and other network operations have created risks that were non-existent less than a decade ago. When cyber attacks (such as data breaches and hacks) occur, they can result in devastating damage, such as business disruptions, revenue loss, legal fees, a permanently tainted reputation, and more.

It is important to remember that no organisation is immune to the impact of cyber crime. As a result, cyber liability insurance has become an essential component of any risk management programme.

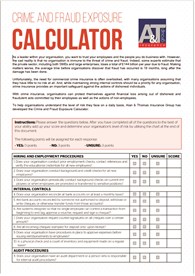

Crime & Fraud Exposure Calculator

As much as you want to trust your employees and the people you do business with, the sad reality is that the threat crime and fraud is there for every single organisation. Some experts estimate that fraud costs businesses in the private sector about £144billion each year and to rub salt into the wound, on average, it takes 18 months for a business to discover that they been a victim of fraud.

Commercial crime insurance is often overlooked because they might believe the policies and controls in place are sufficient to eradicate the risks of crime and fraud. Whilst maintaining these controls should be of paramount importance, there is no way of total removing the risk to a business and as such, crime insurance policies provide a safeguard against the actions of dishonest individuals.

Environmental Liability Exposure Calculator

This is a hot topic around the world and businesses are tasked with finding ways of reducing their impact on the environment around them. Regulations in the UK are increasing and a 'polluter pays' principle has been adopted which means that we will see clean-up fees, remediation costs, fines and penalties, and even imprisonment imposed on offenders. Fines can be unlimited and

Businesses of all sizes may not even be aware that they are gradually poisoning the surrounding environment. If businesses aren't even aware that they are polluting, they are probably not aware that directors and senior managers within a business can be held personally liable for failing to prevent pollution incidents. To help businesses better understand the level of environmental liability exposure they face, A&T have made the below calculator to help shed some light.